b&o tax form

Please file your City BO taxes on the FileLocal portal. General BO Tax Information.

Get Rid Of The Guesswork And Have Confidence Filing With Americas Leader In Taxes.

. The Manufacturing BO tax rate is 0484 percent 000484 of your gross receipts. Sign the form and mail in a check payment for the total taxes due by the Quarterly due date. B.

The Citys B O Tax is based on the gross income gross receipts of each. Rental Property Registration Form. Download the B O Tax form below.

PENALTIES Please provide the following information if there has. Determine your Business Classifications and corresponding rates from the tax table. Business Occupation Tax.

There is no penalty on late. A Business and Occupation Tax is imposed on any persons s engaging or continuing with the state in any public service or utility business except railroad. The tax year is July 1 - June 30 and the due date for returns is August 15.

Get Rid Of The Guesswork And Have Confidence Filing With Americas Leader In Taxes. Use the pre-addressed tax return form. All businesses located in the Village of Barboursville must fill out the Business and Occupation BO Tax Return.

Start completing the fillable fields and. Use Get Form or simply click on the template preview to open it in the editor. You will list all gross income for the appropriate filing period on the return.

It is measured on the value of products gross proceeds of sales or gross income of the business. Ad File State And Federal For Free With TurboTax Free Edition. For the purpose of the tax imposed by Cosmopolis Municipal Code Chapter 344 any person whose value of products gross proceeds of sales or.

Chicago Department of Finance. To file an amended return for a previous. All taxes administered by Bellevue including the Business Occupation Tax and miscellaneous taxes such as utility admission and gambling taxes are reported on the.

More information is available on the application and reporting forms or by calling the BO Tax. It is measured on the value of products gross proceeds of sale or gross income of the business. How to file your BO taxes.

Business and Occupation Tax Forms. BOT-300F Tax Return for Synthetic Fuels. 29 of the tax due if not received on or before the last day of the second month following the due date.

BOT-300G Tax for Gas Storage. Minimum penalty on all late returns where tax is due is 500. FILE PAY CITY TAXES.

The state BO tax is a gross receipts tax. Before viewing these documents you may need to download Adobe Acrobat Reader. You may file and pay your taxes online or mail them to.

All businesses conducting transactions in Lacey whether or not the business is physically located within the city must be registered with the City of Lacey. However should another form be used please include your name address customer number obligation number and the period for which the return is. Taxpayers can use forms available on this website to make application to the Finance Director.

If you would like assistance navigating the FileLocal system please call FileLocal directly at. Ad File State And Federal For Free With TurboTax Free Edition. The tax amount is based on the value of the manufactured products or by-products.

Documents are in Adobe Acrobat Portable Document Format PDF. If this Tax Return is past due the following penalties must be included in your payment - minimum penalty 500 if tax is due. If you dont yet have an Everett business license visit our.

1 Wall Street Ravenswood West Virginia 26164. The City of Everett Business and Occupation Tax BO is based on the gross receipts of your business. In accordance with URPO Ruling 5 effective 112016 tax collectors and taxpayers must file their tax returns electronically.

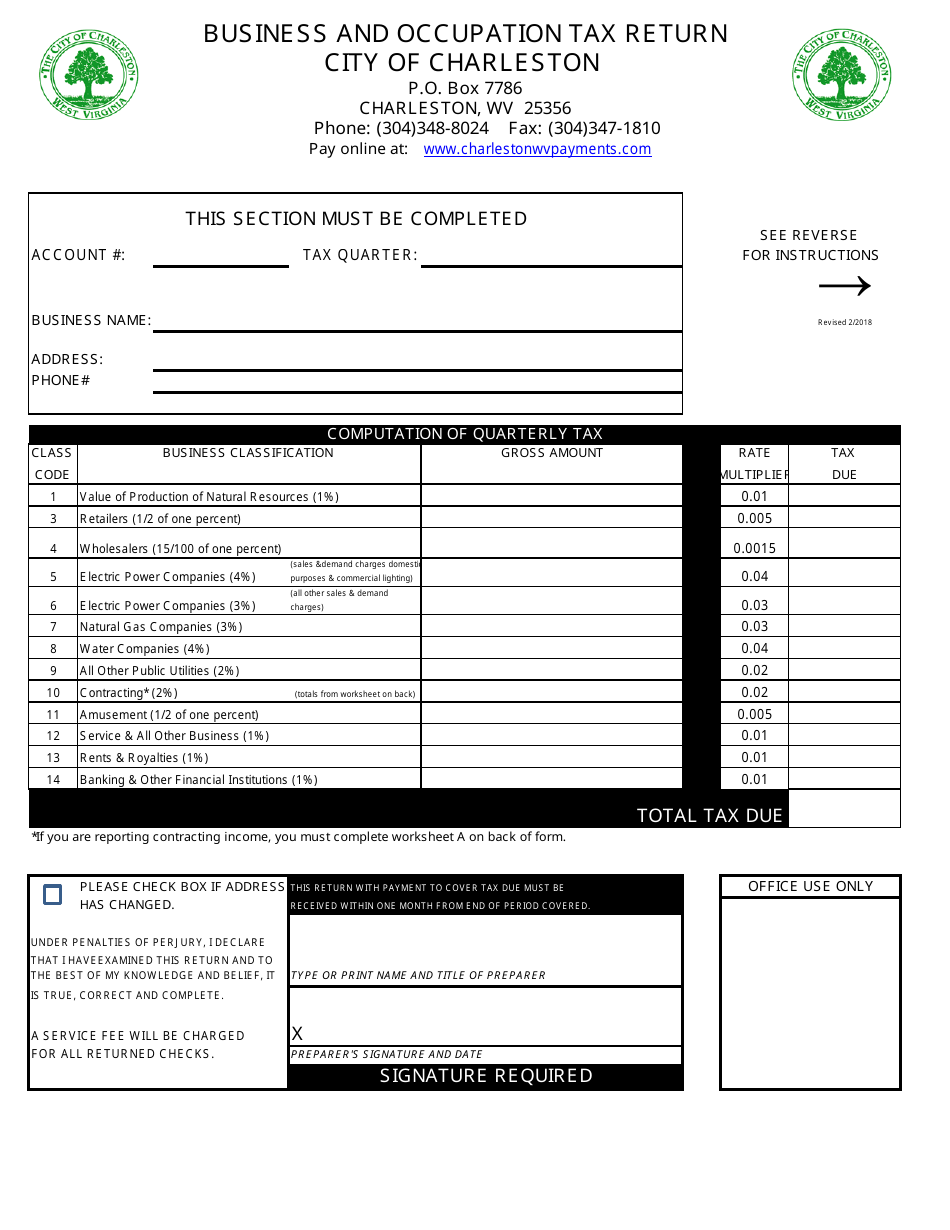

Determine you Charleston BO taxable gross income for each of the classifications and enter it. The City Business Occupation BO tax is a gross receipts tax. What is the business and occupation BO tax.

Business and Occupation Tax. See Codified Ordinances of the City of Wheeling Part 7 Chapter 5 Article 787. BUSINESS OCCUPATION TAX.

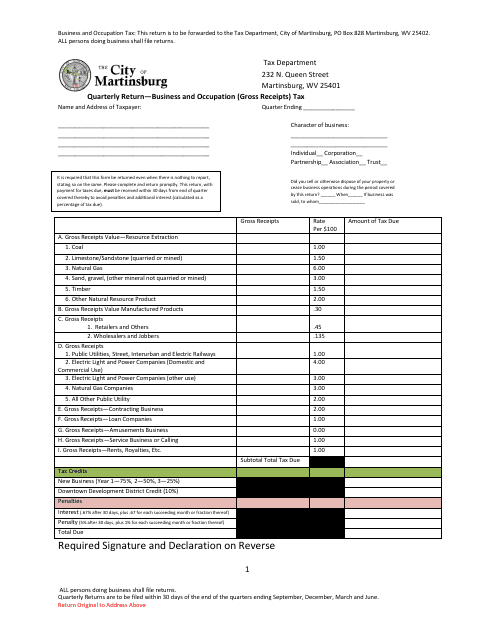

This tax is collected from anyone conducting business within the corporate limits of the City of Martinsburg. To submit your B O Tax Form follow these instructions. Quick steps to complete and design City Of Lacey B O Tax Form online.

City Of Olympia B O Tax Form Fill Online Printable Fillable Blank Pdffiller

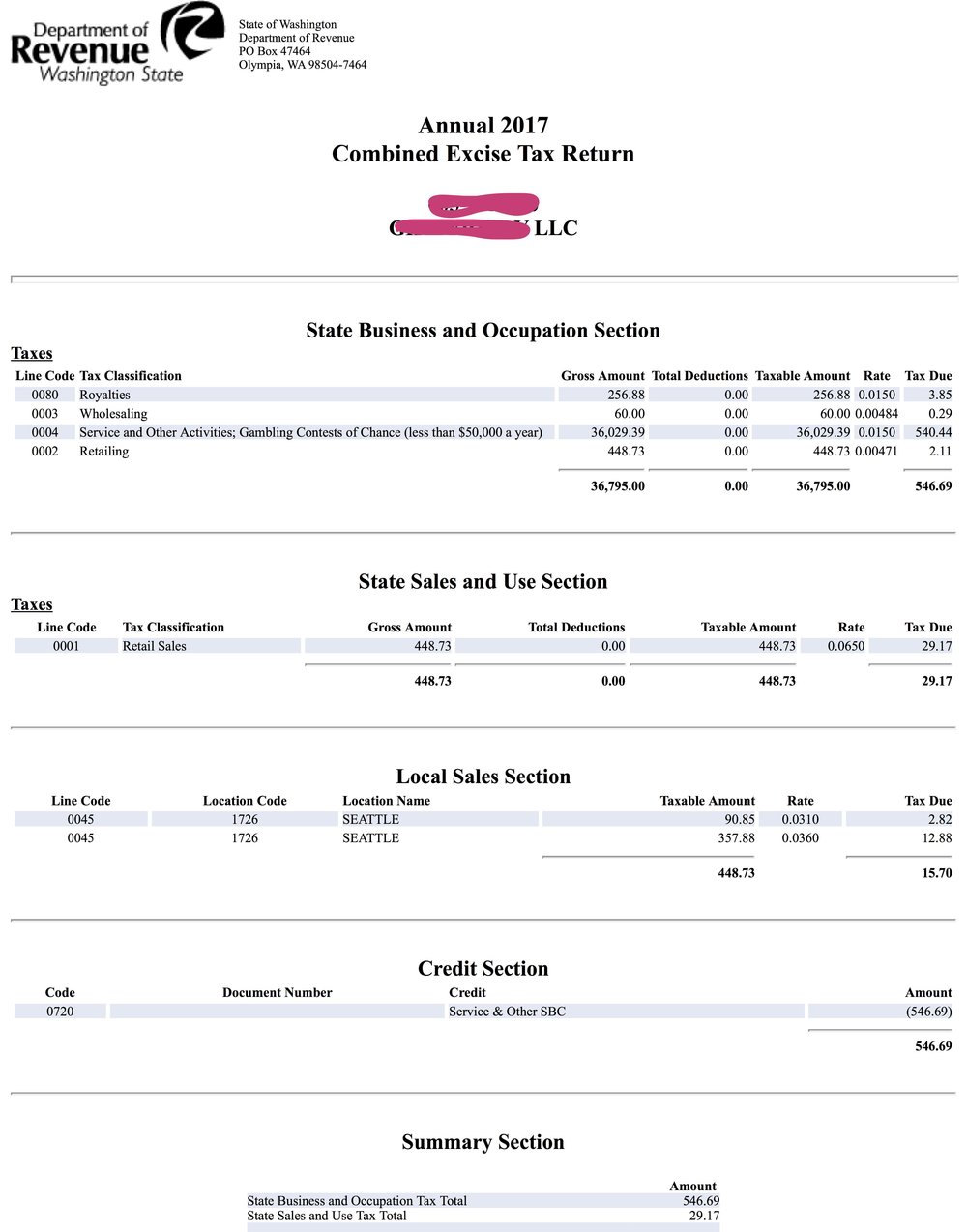

Record Wa Dor Excise And Sales Tax Payment In Quickbooks Online Gentle Frog Bookkeeping And Custom Training

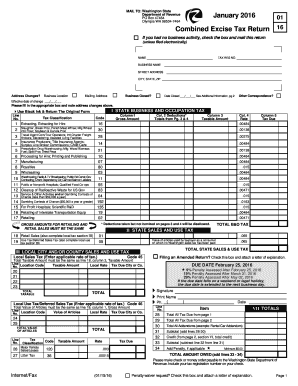

Wei Combined Excise Tax Return Form Fill Out And Sign Printable Pdf Template Signnow

Keep Your Google Speaker From Logging Searches With Guest Mode Apple Watch Fashion Xbox Gift Card Speaker

Wa B O Tax Form Fill Online Printable Fillable Blank Pdffiller

West Virginia Business And Occupation Tax Return Form Download Printable Pdf Templateroller

B Amp O Tax Return City Of Bellevue

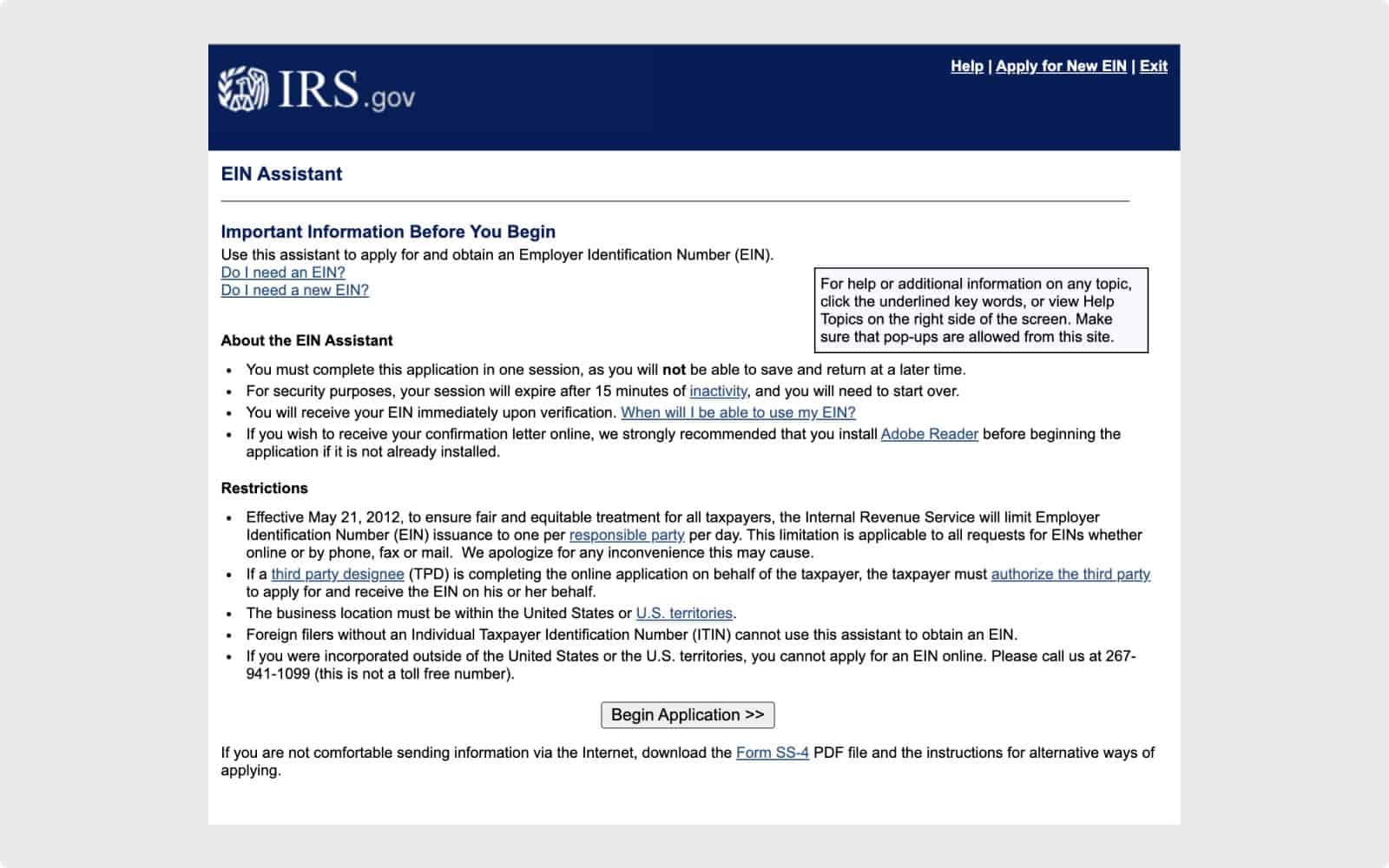

How To Get A Tax Id Number For An Llc Quick Guide Simplifyllc

How To Get A Tax Id Number For An Llc Quick Guide Simplifyllc

50 First B O Passenger Diesel Painted For Abraham Lincoln Service On Subsidiary Chicago Alton Baltimore And Ohio Railroad Alton Train

Tacoma B O Tax Fill Online Printable Fillable Blank Pdffiller

B O Tax Blog Seattle Business Apothecary Resource Center For Self Employed Women

Wa Business Occupation Tax Return Tumwater Fill Out Tax Template Online Us Legal Forms

West Virginia Quarterly Return Business And Occupation Gross Receipts Tax Download Fillable Pdf Templateroller

Tacoma B O Tax Fill Online Printable Fillable Blank Pdffiller