how likely will capital gains tax change in 2021

These included aligning rates of CGT to income tax levels and cutting the annual gains allowance from 12300 to as little as 2000 per person but with fewer assets attracting the charge. However there is a possible solution.

The Tax Impact Of The Long Term Capital Gains Bump Zone

The current exemption amount from the estate tax is 117 million Townsend explained Wednesday during Schwabs Impact conference.

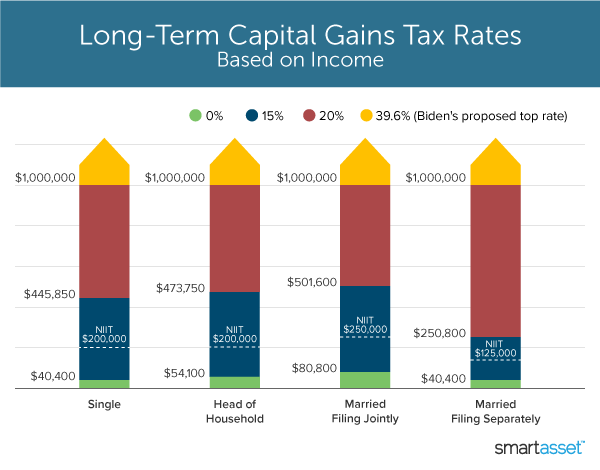

. Long-term capital gains are taxed at lower rates than ordinary income and how much you owe depends on your annual taxable income. For example if Julia bought shares in Apple in February and sold them in November of the same year her gain or loss on the investment will be classified as short-termLong-term capital gains assets held for more than one year are taxed at 0 for taxpayers in the 10 and 15 tax brackets and 15 for. The rates do not stop there.

Additionally the proposal would impose a 3 surtax on modified adjusted gross income over 5000000 effective after December 31 2021. This article is aimed at helping those of you that have highly appreciated assets and would like to sell said asset but feel that the capital gains tax would be prohibitive and eat up your gains. The bill falls apart and there is no capital gains.

If you sell small-business stocks or collectibles the maximum capital gains tax rate is 28. Will capital gains tax change in 2021. On April 28 2021 Joe Biden proposed to nearly double the capital gains tax for wealthy people to around 396.

Get Access to the Largest Online Library of Legal Forms for Any State. Reducing the annual allowance would mean more people. This could result in a significant increase in CGT rates if this recommendation is implemented.

Democrats make the change effective back to April or May though this seems very unlikely. Are You Looking For International Tax Advisors. The annual exempt amount could be reduced from 12300 per annum to between 2000 and 4000 a dramatic.

1 2022 or later this is certainly possible. Additionally a section 1250 gain the portion of a. Democrats compromise on a prospective effective date of Jan.

Ad Our clients lower their global effective tax rate and reduce risk. Changes to Capital Gains Tax 2021. But if youre in a higher tax bracket ie 32 35 or 37 then the capital gains tax on your collectible gains is capped at 28.

By Marc Frye Nov 18 2021 The American Retirement Advisor Blog. The current capital gain tax rate for wealthy investors is 20. The OTS review of CGT published in September suggested four key changes as part of an overhaul.

20 on assets and property. Specifically the current top capital gains rate is 238 20 plus a. Many speculate that he will increase the rates of capital gains tax to help raise cash necessary to recoup the public costs arising as a result of the COVID-19 pandemic.

The proposed capital gains tax reforms of which any Budget announcement would. The proposal would increase the maximum stated capital gain rate from 20 to 25. The effective date for this increase would be September 13 2021.

There are several potential scenarios in which gain harvesting may not be beneficial. Bidens tax plan called for a hike in the long-term capital gains tax rate but only for the richest Americans. 10 on assets 18 on property.

For taxpayers with income above 1 million the long-term capital gains rate would increase to. Short-term capital gains are taxed like ordinary income at tax rates. The Chancellor will announce the next Budget on 3 March 2021.

Should CGT fall in line with income tax liability will go up to at least 18 to 20 or more so for most investorssecond homeowners from 28 to 40 for higher-rate payers. You Have Come To the Right Place. Plus a change to the capital gains rules with a midyear effective date eg a 20 top capital gains rate for pre-April 2021 sales and a.

With both the Senate and the House under Democratic control the Biden administration could potentially still make changes to the capital gains tax in 2021. Proposed changes to Capital Gains Tax. Such speculation has been fuelled by the chancellors request in July 2020 for the Office of Tax Simplification.

If capital gains tax rates are not aligned with income tax changes should be introduced to the taxation of share based rewards for employees and small business owners to increase the extent to which these are subject to income tax. Once fully implemented this would mean an effective federal. Implications for business owners.

However if you earn less than 1 million any proposed changes will still be in your favor as President Biden will instead be targeting the richest of Americans earning 1 million or more. Long-Term Capital Gains Taxes. Ad The Leading Online Publisher of National and State-specific Legal Documents.

Ad Download The 15-Minute Retirement Plan by Fisher Investments. The Biden tax plan would raise the top marginal income tax rate to 396 from the current 37 level. That amount is scheduled to sunset at the end of 2025 he.

13 will be taxed at top rate of 20. Youll owe either 0 15 or 20. The Budget is fast approaching on 3 March 2021 and there is speculation that the rates of Capital Gains Tax CGT a tax on the difference between an assets value at acquisition and its value at disposal could be increased.

For investors who make 1 million or more who are already taxed a surtax on investment. The changes in tax rates could be as follows. Higher taxes on long-term capital gains now occupy a prime position on the agenda in Washington.

Investors Relief which applies to gains made on the disposal of investments in ordinary shares may come to an end effectively cutting the Capital Gains Tax by 50 to 10. How likely will capital gains tax change in 2021 Monday February 14 2022 Edit. This tax change is targeted to fund a 18 trillion American Families Plan.

Another would raise the capital gains tax rate to 396 percent for taxpayers earning 1. If you have a 500000 portfolio be prepared to have enough income for your retirement.

Biden Will Seek Tax Increase On Rich To Fund Child Care And Education The New York Times

Capital Gains Tax In Spain 2022 How Much Do I Have To Pay My Spain Visa

Capital Gains Tax Advice News Features Tips Kiplinger

What S In Biden S Capital Gains Tax Plan Smartasset

Capital Gains Taxation And Deferral Revenue Potential Of Reform Penn Wharton Budget Model

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

Capital Gains Tax Advice News Features Tips Kiplinger

Selling An Inherited Property And Capital Gains Tax Yopa Homeowners Hub

The Tax Impact Of The Long Term Capital Gains Bump Zone

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

How Capital Gains Affect Your Taxes H R Block

A Complete Guide To Capital Gains Tax Cgt In Australia

Here S How Much You Can Make And Still Pay 0 In Capital Gains Taxes

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

/CapitalGainsTax-e7789cc983e14474abf5d3f345ff6c8a.jpg)

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)